Financial Services Alternative Data

What is Alternative Data?

Alternative data is the term used to describe any non-traditional data that is used to gain insights into consumer behavior, market trends, and other business intelligence. In finance, alternative data is commonly used to supplement traditional data sources, such as financial statements and company filings. Some examples of alternative data include social media activity, business activity in a particular area or region, satellite imagery, and credit card transactions. The use of alternative data is not a fad, but rather a growing trend in the financial industry that is expected to continue to gain importance in the years to come.

Alternative data is becoming increasingly important in finance as companies look for new ways to gain an edge in a highly competitive market. By supplementing traditional data sources with alternative data, financial institutions can better understand consumer behavior and market trends, which can ultimately lead to better decisions and improved performance.

What is the advantage of alternative data?

For example, alternative data can be used to track consumer sentiment about a particular product, which can help companies make better decisions about marketing and product development. By analyzing social media activity, companies can identify emerging trends and consumer preferences, which can inform their business strategies.

Alternative data can also be used to gain insights into the performance of companies that are not publicly traded. By analyzing satellite imagery or credit card transactions, for example, investors can gain a better understanding of a company’s operations and financial performance.

Overall, alternative data is not a fad but rather a valuable tool for financial institutions across the spectrum looking to gain a competitive edge. As technology continues to advance and new sources of data become available, the use of alternative data is expected to become even more widespread in the financial industry.

Where to acquire Alternative Data?

Traditionally acquiring alternative data was really difficult, it would be really challenging to be able to get various information needed to collect, maintain and analyze the data. But with the advent of several organizations in this space, currently, the data is more easily available with some cost involvement. Data collected and delivered/available through these aggregators would range from weblogs (who is visiting a website, how long, what are they doing., etc), mobile app usage to Uber rides taken (which type of car did one drive, what are the trends for a certain area, how long did they drive).

Alternative data has become more accessible and affordable in recent years thanks to advances in technology and data processing. This has made it possible for smaller companies to compete with larger ones that have traditionally had access to more resources and data. Additionally, the rise of cloud computing and big data analytics has made it easier for companies to store and process large amounts of data, including alternative data.

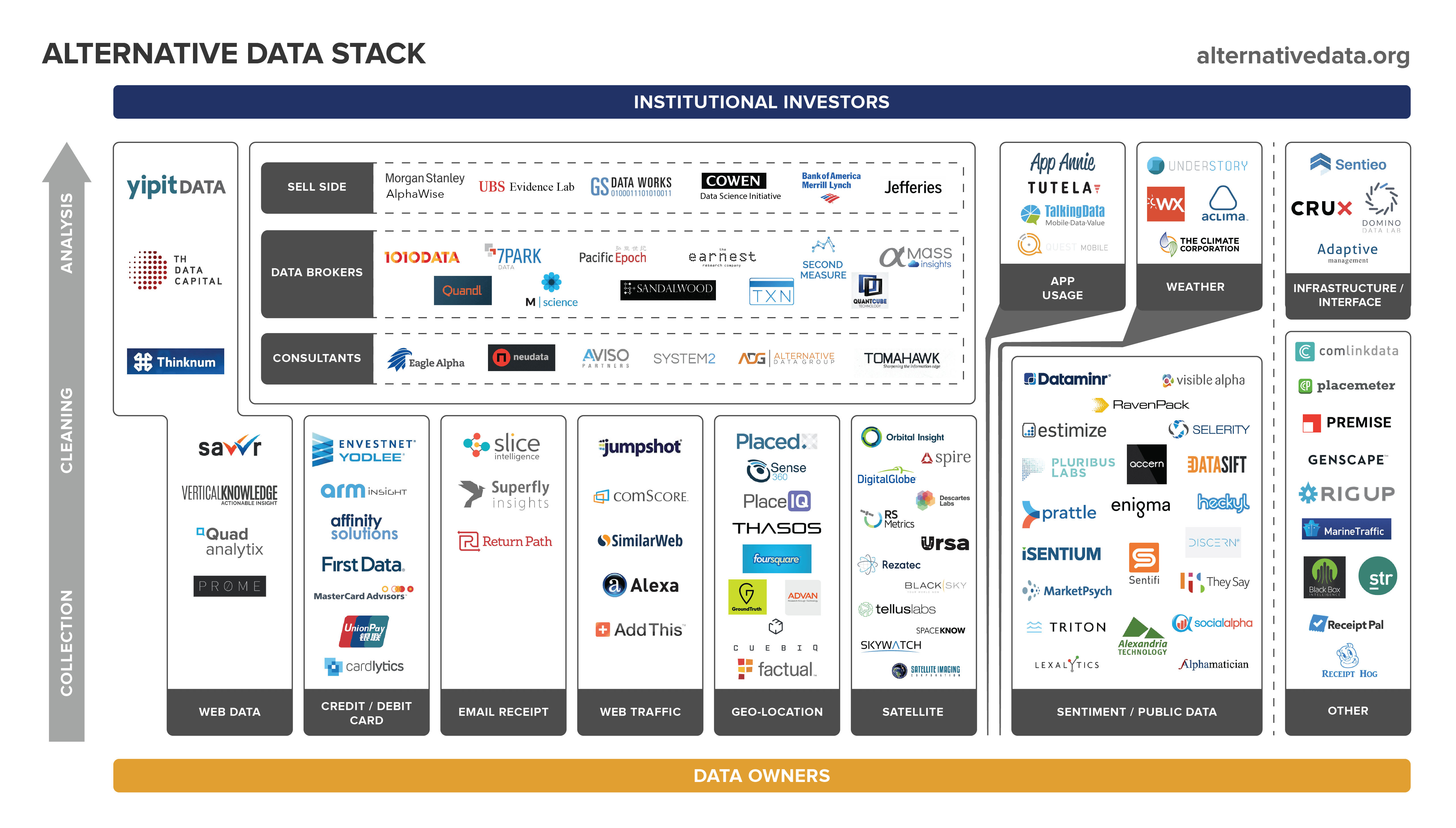

Alternative data is provided by several providers such as:

- Yipit Data

- Thinknum

- Exploding Topics

- Transparent

- Visible Alpha

*Credits: alternativedata.org

Alternative Data Types

App Usage — Data on app engagement and reviews. Popular use cases: gaming, food delivery, streaming services. Credit/Debit Card — Transaction data generated from credit and debit cards. Email/Consumer Receipts — Transaction data generated from email receipts. Geo-location — Popular use cases: Geography-specific retail foot traffic tracking. Public Data — Data from public resources. In its original form, this data is often difficult to access, not clean, and not in a usable format. Job Market Data — Data from sources that provide information on the employment opportunities in a country and how they are being churned. Satellite — Data collected from satellites or (increasingly common) low-level drones. Popular use cases: supply chain disruption tracking; agriculture yields tracking; construction tracking; oil & gas production/storage. Sell-side — Alternative data teams within large sell-side institutions. Combine new data and processing techniques with traditional sell-side research. Social/Sentiment — Data obtained from text processing of social media, news, management communications, and other sources. Survey — Data collected from surveys. This requires opt-in and panel diversity is variable depending on how good the provider is. Weather — Data on weather patterns collected from sensors. Popular use cases: agriculture and commodities. Web Data — Data scraped from public websites. This data comes in a wide range, from highly accurate and expensive to extremely raw and relatively inexpensive. Web Traffic — Data on quantity, demographics, and history (clickstream) of users visiting a certain website. This is popular for tracking e-commerce efforts. Other — There are many other popular datasets, including point-of-sale data, ad spend data, pricing data, and much more. These are not yet broad enough to capture a full section.

The sample Onboarding process for Alternative Data

For any great change an idea is the trigger, similar is the case of Alternative Data. First portfolio manager looks for an opportunity for identifying the opportunity in a targeted and specific industry, or business case to better understand the financial impact. This then leads to searching relevant alternative data providers, which are tested for usability based on data available within organization.

How to enable insights into Alternative Data?

IOMETE provides a versatile analytical platform to merge the data which is sometimes available in the Snowflake Data Platform and merge that data with your local data using Query Federation. What does this mean, data is staying in their source system for testing purposes, and need not be loaded into a central platform or anywhere for working on it.

IOMETE provides an efficient processing engine once the data is onboarded and delivers a very efficient way to connect to the data which is available in the Snowflake Marketplace or any other marketplace for delivering insights to the portfolio managers.

Portfolio managers, Data Analysts, and Data Engineers can equally benefit to use the platform with a fixed flat fee for the usage of the platform, while not worrying about too many costs but only enabling the teams and delivering value.

In summary, alternative data is a growing trend in the financial industry that is expected to continue to gain importance in the years to come. By supplementing traditional data sources with alternative data, financial institutions can gain valuable insights into consumer behavior and market trends, leading to better decisions and improved performance.